Have you ever wondered what separates millionaires from everyone else? Here’s the surprising truth: It’s not luck, inheritance, or even intelligence. After studying over 233 millionaires for five years, researchers discovered that wealth isn’t built through grand gestures or get-rich-quick schemes. Instead, it comes down to simple daily habits that compound over time—habits so accessible that anyone can start practicing them tomorrow.

The most shocking part? These habits have nothing to do with how much money you currently have. Whether you’re earning $30,000 or $300,000 a year, the same principles that create millionaires can work for you. Ready to discover what the wealthy do differently every single day? Let me take you inside the daily routines that build fortunes.

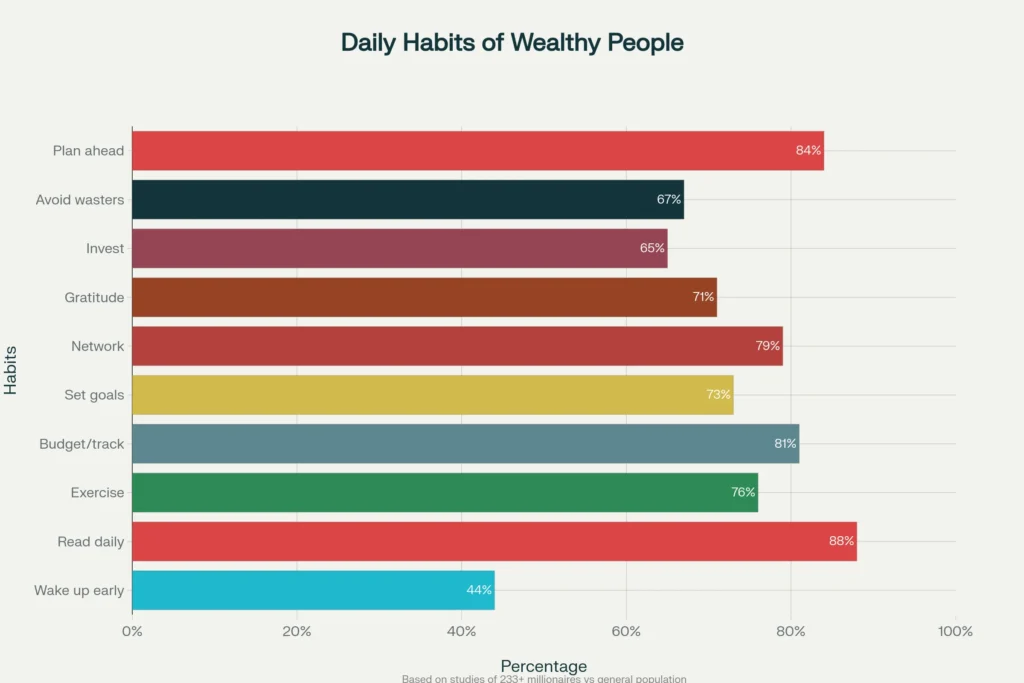

Daily habits of wealthy people with research-backed statistics showing the percentage of millionaires who practice each habit

The Morning Foundation: How the Wealthy Start Each Day

1. They Wake Up Early (And Use Those Extra Hours Strategically)

Wait till you see this… 44% of millionaires wake up at least three hours before their workday begins. But here’s what’s fascinating—they’re not just waking up early to suffer through longer days. They’re creating what psychologists call “controlled time”—precious hours when the world is quiet, distractions are minimal, and their mental energy is at its peak.

Mark Wahlberg starts at 3:30 AM, Dwayne Johnson begins his day at 3:30 AM, and Richard Branson is part of the famous “5 AM club”. But here’s the key insight: Early rising isn’t about being miserable. It’s about winning the day before it even begins.

The science backs this up. Research shows that our cognitive abilities peak in the morning, and willpower actually depletes throughout the day. By tackling their most important tasks first thing, wealthy people ensure their best thinking happens when their brains are sharpest.

How to apply this: Start by waking up just 30 minutes earlier than usual. Use this time for activities that move you toward your goals—whether that’s exercise, reading, or planning your day. Gradually increase this window as it becomes natural.

A steaming cup of coffee on a wooden table with a peaceful sunrise in the background, symbolizing a calm morning routine

2. They Have Sacred Morning Rituals

Here’s what most people get wrong about morning routines: They think it’s about following someone else’s exact schedule. The wealthy understand it differently. They create what researchers call “sacred morning rituals”—personalized routines that prepare their mind and body for peak performance.

Warren Buffett spends 80% of his day reading. Bill Gates dedicates his first hour to reflection and learning. Elon Musk considers his shower the most important part of his morning because it “wakes him up and puts him in the right headspace”.

The pattern is clear: Successful people don’t rush into reactive mode. They intentionally design their mornings to cultivate focus, energy, and clarity. This isn’t about copying their exact routines—it’s about creating your own ritual that serves your goals.

The psychological impact is profound. As leadership expert Robin Sharma notes: “Take excellent care at the front end of your day, and the rest of your day will pretty much take care of itself”.

Also Read To start a millionerd Journey :- Click Here This Article

3. They Exercise Without Fail (Even When They Don’t Want To)

76% of wealthy people exercise regularly, and here’s why this habit is so powerful: It’s not really about fitness. Exercise is their daily training ground for discipline and mental toughness.

Listen to this insight from a billionaire: “Developing discipline is one of the most crucial things you need to be successful. Being successful comes with a litany of things that you’re not going to want to do, but you’re going to have to do them anyway”.

A woman performing a side stretch exercise with a kettlebell outdoors by the ocean, symbolizing healthy morning habits

The wealthy use exercise as a way to prove to themselves that they can do hard things consistently. This translates directly into business and financial decisions. When market volatility hits or tough choices need to be made, they’ve already strengthened their discipline muscle through daily physical challenges.

Research supports this connection. Regular exercise increases focus, reduces stress hormones, and literally rewires the brain for better decision-making. It’s no wonder that people who exercise regularly tend to have higher incomes and better financial outcomes.

The Learning Obsession: How Knowledge Builds Wealth

4. They Read Like Their Success Depends On It (Because It Does)

Here’s a statistic that will blow your mind: 88% of wealthy people read for at least 30 minutes every day, compared to just 2% of people with lower incomes. But here’s what’s even more remarkable—they’re not reading fiction for entertainment. They’re systematically building knowledge that gives them competitive advantages.

Warren Buffett once said: “Read 500 pages like this every day. That’s how knowledge works. It builds up”. When he was starting his investing career, he read between 600-1000 pages per day. Today, he still spends five to six hours daily reading newspapers, reports, and books.

Key financial success habits including mindset, goal setting, budgeting, and income streams from a millionaire’s blueprint document

The pattern across wealthy individuals is striking:

- Bill Gates reads 50 books per year (one per week)

- Mark Cuban reads more than 3 hours every day

- Elon Musk taught himself rocket science by reading books

- 85% of wealthy people read at least two educational books per month

But here’s what makes their reading different: They read with intention. They’re not consuming random content—they’re strategically building expertise in their fields and staying ahead of trends that others miss.

How to apply this: Start with 30 minutes of educational reading daily. Choose books in your field, business strategy, or personal development. Keep a reading journal to capture key insights and review them regularly.

5. They Set Crystal-Clear Daily Goals (And Review Them Obsessively)

73% of millionaires maintain daily to-do lists and review their goals regularly. But here’s what separates their goal-setting from everyone else’s: They work backwards from their long-term vision to determine what actions to take today.

Successful people ask themselves one crucial question each morning: “What is the one thing I can accomplish today that will bring me closer to my most important goal?” This isn’t about busy work or checking items off a list—it’s about strategic focus.

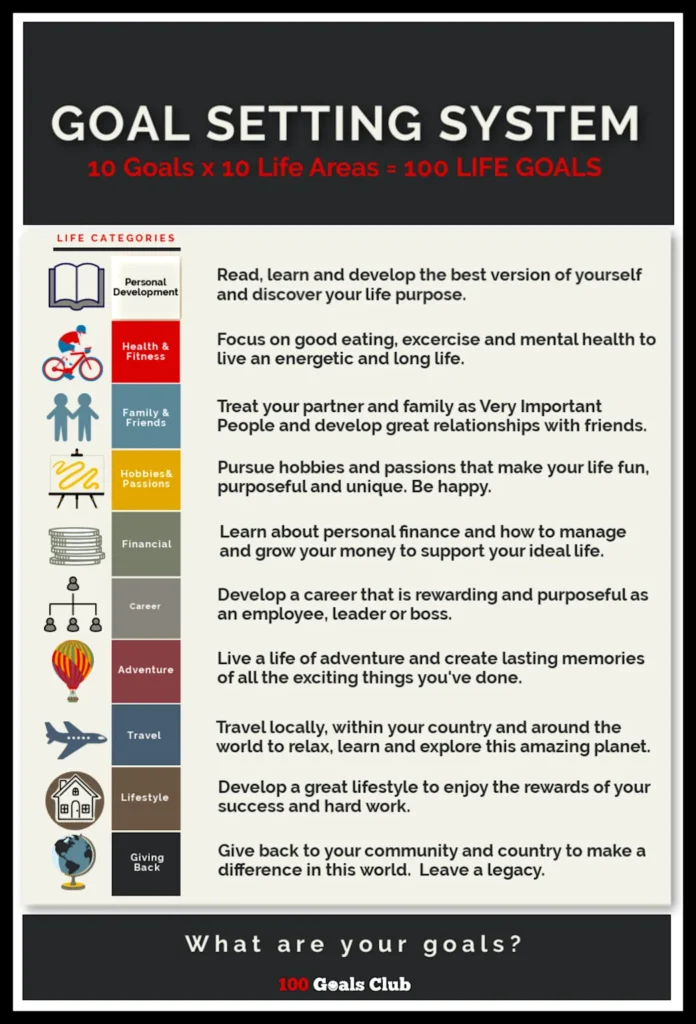

A goal setting system with 10 life categories and key motivational descriptions to guide personal and financial growth

The psychology behind this is fascinating. When you have clear, written goals, your brain’s reticular activating system starts noticing opportunities and resources that align with those objectives. It’s like buying a red car and suddenly noticing red cars everywhere—except with goals, you start seeing wealth-building opportunities everywhere.

Research shows that people who write down their goals are 42% more likely to achieve them. But wealthy people take it further—they break down annual goals into monthly milestones, weekly targets, and daily actions.

How to apply this: Every evening, write down your three most important tasks for tomorrow. Make sure at least one directly contributes to your biggest long-term goal. Review your progress weekly and adjust as needed.

The Money Mastery: Financial Habits That Build Fortunes

6. They Budget Like Their Life Depends On It

Here’s something that might surprise you: 81% of wealthy people maintain detailed budgets and track every expense. You’d think millionaires wouldn’t need to budget, right? Wrong. They budget precisely because they want to stay millionaires and become even wealthier.

Wealthy people follow a principle called “aggressive budgeting”—they know exactly where every dollar goes and optimize ruthlessly. Many follow the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and investments. But here’s the key: They often flip this formula, saving 30% or more of their income.

Digital and physical Rich Life Planner focused on productivity, goal setting, and motivational challenges

The research is clear: 49% of self-made millionaires were “saver-investors” who saved 20% or more of their income from day one of their careers. They understand that wealth isn’t built through high income alone—it’s built through the gap between what you earn and what you spend.

Graham Stephan, a successful investor, puts it this way: “They track their spending meticulously. They know exactly what they spend money on, if it’s the best deal, and where their money goes—nothing is wasted”.

7. They Invest Consistently (Regardless of Market Conditions)

Warren Buffett famously said: “Our favorite holding period is forever.” Wealthy people understand this deeply. They know that time in the market beats timing the market, so they start investing early and never stop.

Here’s the crucial insight: Wealthy people don’t try to get rich quick through investing. They get rich by owning pieces of growing businesses and appreciating assets. They focus on:

- Stock ownership in profitable companies that grow their value over time

- Real estate investments that appreciate and generate rental income

- Business ownership through partnerships or equity stakes

- Commodity investments like precious metals or agricultural products

- Growth-focused mutual funds and ETFs that track business performance

The key principle is asset appreciation: Instead of relying on fixed returns, they invest in assets that grow in value as economies expand, populations increase, and businesses become more productive.

How to apply this: Start with whatever amount you can invest monthly—even $50 makes a difference. Set up automatic transfers so the decision is removed from your daily life. Focus on low-cost index funds, REITs, or fractional shares of quality companies if you’re just beginning. The goal is to own appreciating assets, not to chase quick profits.

8. They Avoid Time and Money Wasters

67% of wealthy people strictly limit their consumption of television, social media, and other time-wasting activities. But here’s what’s fascinating: They don’t see this as deprivation—they see it as optimization.

The research shows that wealthy people view time as their most valuable asset. Instead of passive entertainment, they choose activities that either generate income, build knowledge, or strengthen relationships. They understand the opportunity cost of every hour spent.

Consider this: The average American watches over 4 hours of television daily. If wealthy people used that time for reading, planning, or building side income streams, that’s 1,460 hours per year of productive activity. At just $20 per hour of value, that’s $29,200 of annual benefit from better time allocation.

How to apply this: Track your time for one week. Identify your biggest time wasters and replace them gradually with wealth-building activities. Start with just one hour per day of intentional time use.

The Relationship Factor: How Networks Build Net Worth

9. They Network Strategically (Not Just Socially)

79% of wealthy people actively network and maintain strong professional relationships. But here’s the key distinction: They don’t network just to collect business cards—they network to create mutual value.

The best networkers follow what researchers call the “give-first principle”. They look for ways to help others before asking for anything in return. This creates what psychologists term “reciprocal altruism”—when you genuinely help someone, they naturally want to help you back.

Two businessmen in suits shaking hands outdoors, symbolizing professional business networking and relationship building

Successful people understand three types of networking:

- Operational networking: Building relationships within their company to get things done

- Personal networking: Connecting with peers for professional development and referrals

- Strategic networking: Cultivating relationships that can help achieve long-term business goals

The research is striking: People with strong professional networks earn significantly more over their careers and have access to better opportunities. As one networking expert puts it: “Your network is your net worth.”

10. They Practice Gratitude and Maintain Optimism

71% of wealthy people practice some form of daily gratitude. Here’s why this matters more than you might think: Gratitude literally rewires your brain for abundance thinking.

Psychology research shows that gratitude shifts your focus from scarcity to abundance. This doesn’t mean ignoring problems—it means training your brain to notice opportunities rather than just obstacles. When you’re grateful for what you have, you’re more likely to take positive risks and see possibilities that others miss.

Wealthy people understand that money is as much a mental game as it is a mathematical one. They develop what psychologists call “emotional regulation” around money—they can make rational long-term decisions despite short-term emotional impulses.

Oprah Winfrey practiced gratitude daily for over a decade straight. She credits this habit with helping her maintain perspective and make better decisions even as her wealth and influence grew.

The Compound Effect: How Small Habits Create Big Wealth

Here’s the most important insight from all this research: Wealth isn’t built through dramatic gestures or perfect strategies. It’s built through the compound effect of small, consistent daily habits.

The psychology of wealth comes down to this: Wealthy people have developed the ability to delay gratification, think long-term, and take consistent action toward their goals. They understand that every small choice compounds over time.

As James Clear writes in “Atomic Habits”: “You do not rise to the level of your goals. You fall to the level of your systems.” The wealthy have built superior daily systems, not just bigger dreams.

Your Wealth-Building Action Plan

You don’t need to implement all 10 habits at once. Start with just one or two that resonate most with you:

- Choose your keystone habit: Pick one habit that will naturally lead to others (like waking up 30 minutes earlier)

- Start small: Commit to just 15-30 minutes daily initially

- Track your progress: Use a simple checklist or app to maintain consistency

- Stack habits: Link new habits to existing routines to make them stick

- Be patient: Remember that compound effects take time to show dramatic results

The most important step is the first one. As Warren Buffett said: “The best time to plant a tree was 20 years ago. The second best time is now.”

FAQ: Your Wealth-Building Questions Answered

Q: Do I need a high income to start building wealth?

A: Absolutely not! The research shows that 49% of millionaires were “saver-investors” who built wealth through consistent saving and investing, not high incomes. It’s about the gap between what you earn and spend, not the absolute amount.

Q: How long does it take to see results from these habits?

A: While compound effects take years to become dramatic, you’ll start seeing improvements in focus, energy, and financial awareness within weeks. The key is consistency over perfection.

Q: What if I don’t have time for all these habits?

A: Start with just one habit for 15-30 minutes daily. Most successful people didn’t adopt all habits at once—they built them gradually over years.

Q: Are these habits really more important than picking the right investments?

A: Yes! The research consistently shows that behavior and consistency matter more than perfect investment choices. Good habits with average investments beat perfect investments with poor habits.

Q: Can these habits work in any economic environment?

A: The millionaires studied lived through multiple recessions, market crashes, and economic changes. These habits work because they focus on what you can control: your actions, mindset, and consistency.

Ready to join the ranks of people who never worry about money? The path is clear, the research is solid, and the habits are accessible. The only question left is: Will you start today, or will you still be wishing you had started a year from now?

Your future wealthy self is counting on the decision you make right now. What will it be?

Don’t forget to subscribe to stay updated with more science-backed wealth-building strategies, and share this with someone who needs to see it. Together, we can build a community of people serious about creating real, lasting wealth.

1 thought on “10 Habits Rich People Follow Daily (That Anyone Can Copy)”